Pawn Loans Disclosure Transparency Example

Disclosures Rates & Terms

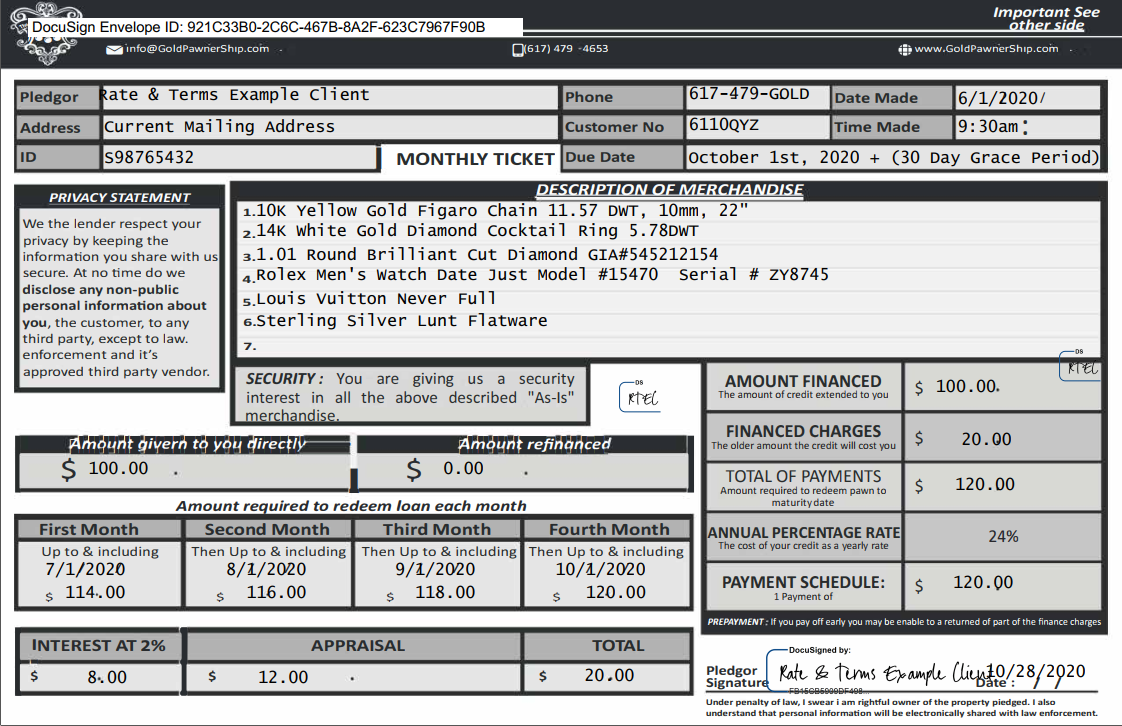

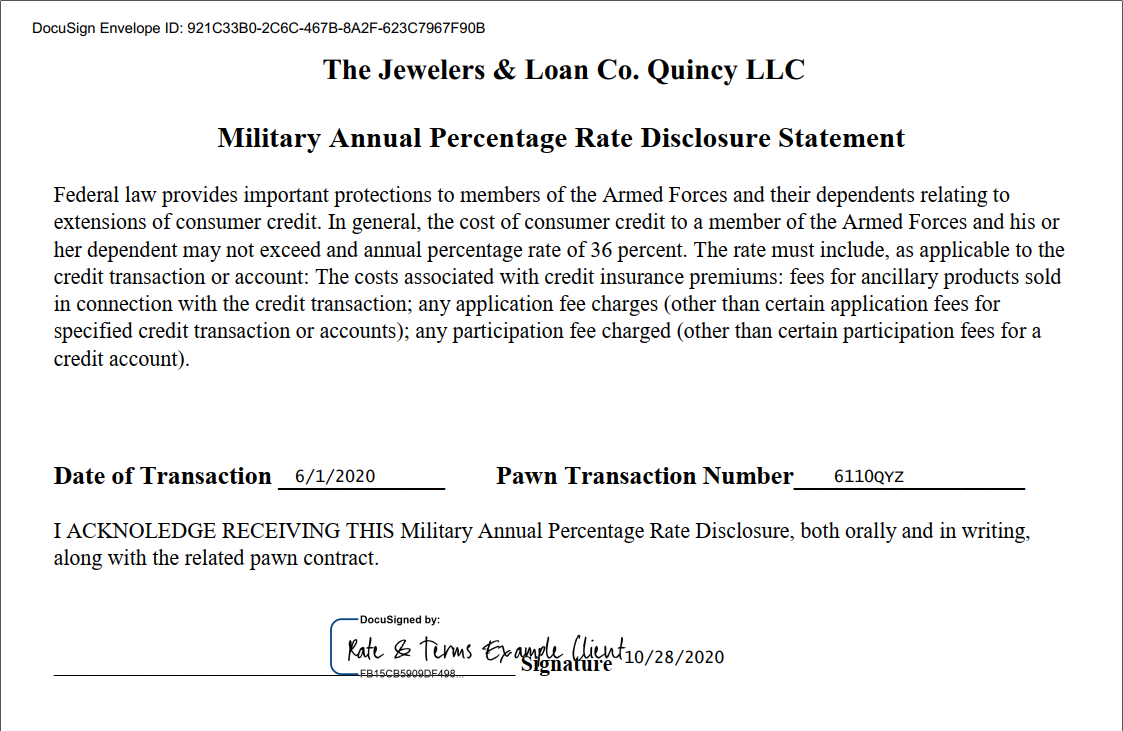

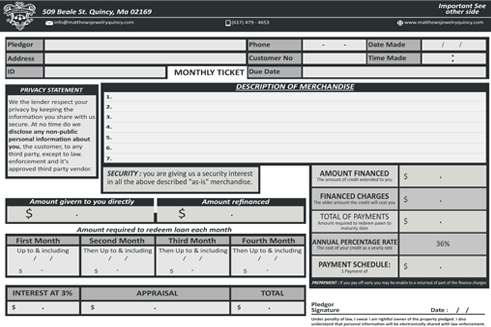

- 24% Annual Percentage Rate (APR) Maximum

- One Day Minimum Period for Repayment or Four Months with a Thirty Day Grace Period.

- $20.00 Maximum amount of Finance Charge on $100.00 Pawn.

- Appraisal Fee Standard on all Pawn Loans.

- Pawn Loan Featured Example on $100 Gold Pawn Loan.

- 1st Month Up/Until Redemption Amount $114.00

- 2nd Month Up/Until Redemption Amount $116.00

- 3rd Month Up/Until Redemption Amount $118.00

- 4th Month Up/Until Redemption Amount $120.00

Benefits

- Pawn Loans are based on the value of the underlying Collateral Quality of the Gold Jewelry, Silver, Diamonds, Coins, Luxury Watches, Sterling Silverware, & more.

- High Cash Payouts

- Safe, Secure, & Confidential

- No Credit Check, Fast & Confidential Funds. Less Expensive than Overdraft Banking Fees. Local.

- Redeem Pawn, Renew Pawn, or Default. Clients Choice.

- Borrow $100 + in Less Than 5-Minutes

- Digital Receipts No Lost Ticket Fee

Risks

- N.B. Risks involved Include, but not limited to; the sale or forfeit of items pledged if the finance charges or redemption is not made prior to the expiration notice of sale date.

- Items are not Insured in case of Fire, Riot, Act of God, Theft, Damage, consideration will made already for pledged items.

How Pawn Loans Work & The Future of Pawning Made Easy!

How Pawn Loans Work are simple and easy. You can Borrow using the Jewelry, Silver, Gold, Coins, Luxury Watches as Collateral. Pawn Loans use the value of the collateral to obtain short term money that you need.

GoldPawnerShip is a one of a kind pawn process that was first initiated in 2009. The pawn industry has been around for hundreds of years and has evolved since its inception. It is a convenient and secure way to get cash, starting at as little as $100 and up. We want to serve all customers throughout the world, by providing more convenient access to cash near you. Borrow or sell your items, you choose, in less than 5-minutes. Simply locate a GoldPawnerShip location from your phone or computer, then stop into an affiliated and vetted physical GoldPawnerShip location near you. Deposit your items, and receive a receipt and the cash you need! Pawn loans made easy! See the items we pawn at our site page, What We Pawn Borrow On.

Safe & Secure Storage

Private & Confidential

High Cash or Check Payouts

Safe and Secure Pawn Loans on your Jewelry or Valuables. Borrow $100+ in under 5 minutes.

✔ 4-month loan term

✔ Does not affect your credit score

✔ 3 options on your pawn loan

- Redeem pledged items

- Renew your pawn loan

- If you default, there is no damage to personal credit

The pawn business is an old business, “Older than dirt”, as they say. Pawn loans have been around for centuries, first started by the Medici family in Italy. Pawn loans are smaller dollar collateral loans made by pledging your jewelry or valuables as collateral. Pawn loans are essentially microloans. Pawn Loans are safe and secure, and we offer high payouts.

Get cash for your valuables in 3 easy steps

Step 1. Gather your valuables

First, gather the jewelry you’re interested in selling, pawning, or getting a loan on. Gold jewelry, diamonds, sterling silverware, coins, old paper currency, and luxury watches are popular items. Don’t bother cleaning them, as we can do this for you. Leave them in a jewelry box, jewelry pouch, or throw it in a ziplock bag as many of our clients do.

Step 2. We’ll evaluate the authenticity, condition, quality, and weight

Come in during business hours. Call, text, or email us. Send us a Picture of your items. 617-479-GOLD (4653). You will be in and out in 5-Minutes.

Step 3. We’ll make you a cash offer instantly on the spot

It’s that simple. You’ll then get an instant cash offer on your items in front of you and can have money in hand in under 5 minutes. If you have something in mind to sell, why not get a cash price to sell today?

Frequently Asked Questions

Selling for Cash Vs. Pawning for Cash. What is the difference?

Selling your items means they are gone forever. Pawning allows you the option to redeem your items based on a period of time, redemption-payment schedule, maturity, and grace period deadlines.

What will the credit or money you borrow cost me on my pawn loan?

The cost is determined by the amount you borrow, which is based on what your collateral is worth. Each month allows a redeemable amount, and a payment schedule is provided so you can easily understand what it costs each month.

How much time do I have?

The maturity date (due date) is 4 months from the original transaction date. There is a 30-day grace period allowed at no additional charge after the maturity date. This means we will hold your items for 150 days.

Is there a Limit to how many times I use the pawn loan service?

In most cases, no. The amount borrowed is based on an LTV (Loan to Value) on your jewelry, gold, diamonds, coins, luxury watches, old paper currency and more.

Will I be notified when my maturity date arises?

Yes, we will send you a certified letter mailed to your current address that you provide to us on your pawn receipt. We will send the “Notice of Default” letter after the maturity date to remind you to come to redeem your items, renew the loan, or, in a worst-case scenario, the items are sold with no damage to your personal credit.

Security Concerns & Package Handling

At the Jewelers & Loan Company of Quincy, Massachusetts, we understand that sending your valuables through the mail is a concern.. We have a physical location in Quincy that is conveniently located – you’re free to stop by, or if you prefer, email, text, or call at 617-479-4653 (GOLD). We have been pawnbrokers and jewelers since 2009, operating with a physical location in historic Quincy, Massachusetts. We provide 24/7 video surveillance, meaning your items are stored in a vault with owner access only, along with alarm monitoring. Items are photographed digitally, logged into our inventory system, and sealed in plastic bags for storage in our vault only accessible by the owner and management. In our GoldPawnerShip vision, we want to have affiliate jewelers, pawnbrokers, and eventually, banks where customers can simply use our application and website to streamline and make the pawning process easy, professional, ultimately more universally acceptable socially.

What is the payment schedule like?

The payment schedule on a gold or diamond pawn loan is broken down into four redemption prices every month, over a four-month period. You can clearly see what it costs each month to redeem your pawn loan. If you are waiting on a check for bi-weekly pay or commission, We give you the flexibility – you can choose to come in each month and make payments, come in before the four-month maturity date is due to pay off the loan, or choose to do nothing, which means you are in effect “selling” your pawned item. There is also a free thirty day grace period. Please see the example below.

Do I get more if I pawn loan or sell?

Most times you get more if you sell outright. For example, if you have a gold chain that is worth $100, you can borrow/pawn/loan for $50 to $80. You can expect to get cash prices for gold and diamonds from $60 to $85. You get more money if you sell outright. If you wish to use the items again, aim to borrow or pawn loan. If you do not use the gold jewelry and diamonds, then selling for cash would be the better option.

Our Pawn vision “GoldPawnerShip” for the World:

We want to partner with local jewelers, pawnbrokers, and jewelry stores (hopefully one day banks will offer the service) all across the country and the world via our website and mobile application that would allow any user with a smartphone to locate a “GoldPawnerShip” affiliate location and obtain $100 and up right away in their immediate physical location. Simply locate your closest GoldPawnerShip location and stop in with your items. The Jeweler or GoldPawnerShip affiliate will pay you on the spot, give you a receipt, and you may redeem your items upon successful completion of the repayment terms. In Europe and India, banks are providing the gold loan service but is not yet part of American culture. The pawn industry often has a bad reputation, but can be re-envisioned with this approach for the following reasons.

The pawn business has not changed much in 350 years. The same old tired stereotype exists in the pawn business when in reality, using your credit card is no different than a pawn loan and yet, the negative aspect of the pawn business still exists. Sometimes, unexpected life events happen. People may run into situations where property taxes get too expensive, fixed income is not enough, loss of job, marriage separation occurs, emergency repairs are needed, self-employment fails, college expenses become a burden, or credit scores may not be strong enough. There is a risk that the bank might not finance you due to their underwriting guidelines. We want to help people gain access to the money they need in a convenient and secure way. We believe PawnerShip pawning is going to be the way of the future.

The goal is to make the GoldpawnerShip an easy, secure, and respectful way of obtaining funds across the country. In 2007, when I started learning the business of jewelry, I found that building out more brick and mortar locations would be difficult with the advent of Amazon and the cost of retail storefronts coupled with Signet Jewelers nearing a monopoly on the jewelry retail industry. The average age of jewelers is relatively high compared to other professions and we believe that the local businesses should stick together. GoldPawnerShip provides better customer experience and will increase the profit of the local GoldPawnerShip affiliates without harming their local business. The process of mailing in your gold jewelry was always an option, but it eliminated a large part of the retail pawn market. Having kiosks where one could deposit valuables would be difficult to implement and security concerns would arise. Our vision for the future of the pawn business benefits the users, partners, and owners. Facebook, Google, Amazon, Uber, Microsoft were all shapers of their industries. A common trait around the amazing stories of these large companies is that they actually provide value and increase productivity overall in their industry. This is the ideal vision for the pawn business.

How much will it cost me if I only need the money for one or two weeks?

The payment redemption schedule on a gold or diamond pawn loan is broken down into four redemption periods & prices for each month to redeem your pledged property, over a four-month period. If you are waiting on a check for bi-weekly or commission, or your boss did not put in for overtime two weeks; the cost to use $100.00 is the same for 1 day as it is for 28 days, so we recommend you use it to your advantage.

Do I get more if I Pawn Loan or Sell?

Most times you get more if you sell outright. Example; if you have a gold chain that is worth $100.00; you can borrow/pawn/loan for $50.00 to $80.00. You can expect to get cash buyer prices for gold and diamonds from $60.00 to $85.00. You get more money if you sell outright. If you use the items try to borrow or pawn loan. If you do not use the gold jewelry and diamonds sell for cash. If you want the option to redeem your jewelry or diamonds go with the loan/pawn/borrow option.

Responsible Pawning

We always advise to only borrow what your personal budget allows. The benefit of pawn loan is that even in a worst case scenario, it does not damage your credit if you can not renew or redeem your pledged items. Set aside some funds separately in a different area so you will not spend all the money at once.

Our Pawn vision “GoldPawnerShip” for the World:

Our vision for the pawn industry has been the first of its kind in the industry. Other pawn businesses have attempted to scale their business via the internet mail-in method, using marketing experts, or by opening up more brick mortar stores. We want to partner with local jewelers and jewelry stores all across the country and the world via our website and mobile application that would allow any customers with a smartphone to locate a “GoldPawnerShip” affiliate location. Simply locate your closest GoldPawnerShip location and stop in with your items to get the fast 5-minute micro cash you need.

We have to give credit to the famous pawn star celebrities for being in the business for a long time and making the pawn industry more well known. There may be very well to do individuals who avoid discussing the pawn business because of its reputation, but growing up in a middle-class family and experiencing living the way most Americans live, I don’t see an innate issue with the business. I see offering another service in the loan marketplace while implementing technology as being a positive thing.

Why GoldPawnerShip Vision?

We understand that mailing your jewelry into your online store will not work as well. No one wants to send their valuables via mail to an unknown location or person. Most customers want to see, touch, and feel an actual store. The pawn business has not changed in 150 years. The same old, tired, and stereotype exists in the pawn business, when in reality the fact is that using your credit card is very little difference than a pawn loan and yet, the negative aspect of the business exists. The cost of living rises every year and wages have not kept up with inflation of every day living and pawning is more relevant today than it ever was. Life events happen, people and family run into situations where property taxes get expensive, fixed income is not enough, loss of job, marriage separation, emergency repairs, self-employed it is not easy to run your own business, college expenses, credit score maybe not strong enough, the bank might not finance you for their underwriting reasons. We want to help people gain access to the money they need in a convenient way.

The goal is to make the GoldpawnerShip an easy, secure, and respectful way of obtaining funds across the country. In 2007 when I started learning the business of jewelry I found that building out more brick and more locations would be difficult with the advent of Amazon and the cost of retail storefronts. The mailing in your gold jewelry was always feasible, but eliminated a large part of the market. Having kiosks where you would deposit the valuables would be difficult to implement and security concerns would arise. Our vision for the future of the pawn business benefits the customers and partners. Facebook, Google, Amazon, Airbnb, Uber, Microsoft were all industry changers. The pawn business has not changed since inception like these genius creators of these aforementioned names. This is the best vision for the future by allowing collateral micro financing readily available across the globe.

We have to give credit to the famous pawn star celebrities for being in the business for a long time and making the pawn industry more well known. There are very well to do people that will not have discussions about the business, but growing up in a middle class family and experiencing living the way most Americans live, I don’t see why offering another service in the marketplace while implementing technology is a bad thing.

What does the word Pawn mean?

The word pawn has both Latin and French origins. In Latin, “Pawn” stems from “pannus”, meaning cloth or clothing. In French “Pawn” stems from pan meaning skirt or blouse.

How much can I get for my diamond?

Diamond prices are determined by the carat weight, color, cut, shape, the demand on the retail market place for the diamond. Better quality, higher price.

My engagement ring has two carats of total carat weight c.t.w & I paid $7,500.00 for it. I want to get at least half of what I paid…

We always tell our customers do not buy diamonds based on carat total weight. Most customers do not think about the resale value upon making a purchase and there is a low re sale value when you try to sell a c.t.w ring generally. These are higher profit items that large chains will sell to customers.

I lost my receipt – can I still pick up my items?

Yes. With identification and additional paperwork, you will still be able to pick up your pawned items. There is no fee for a lost receipt, but be sure to have identification on you.

Can I send someone to just pick up my pledged items for me?

No. Only the person who is the pledgor may pick up the items, though there are rare exceptions.

Can I choose to sell my items once they are in pawn loan?

This is allowable only if you choose to buy back or redeem your items. You may also just let the items pledged to go. Sometimes it does not make sense to do this if the payout amount is already high.

Do I need to pay monthly, weekly, or just before the maturity date?

Please follow the maturity date guidelines. As long as you come in before the maturity date and grace period, your items are safe. We always send out a letter as a reminder if you miss your maturity date.

Security concerns and package handling

At the Jewelers & Loan Company, we understand sending your valuables to us is a concern, and our goal is earning a trusting relationship with you.. We have been pawnbrokers and jewelers since 2009, operating with a physical location in historic Quincy, Massachusetts. We provide 24/7 video surveillance, and your items are stored in a vault with owner access only, along with alarm monitoring. Items are photographed digitally, logged into our inventory system with unique inventory identification numbers, and sealed in tamper-resistant bags for storage in our vault only accessible by the owner and management.

About Us

Our founder started out in 2009 as a jeweler, bench jeweler, pawnbroker, custom jewelry designer, and jewelry and watch repairman. What started in a college dorm room turned into a small storefront in Quincy, Massachusetts. We’ve always been interested in the markets and experienced the “Great Recession” and the bleak job market that ensued. Now, our main focus now is buying and pawning on gold jewelry, diamonds, coins, luxury watches, sterling silverware, old-paper currency, and more. We offer next day delivery on all online jewelry orders. Our GoldPawnerShip vision for the future of the pawn industry is the first and one of a kind in the world. The “about us” section is still being written in a sense, as we continue to grow. We are excited about the future of the pawn industry, and we would like to thank the past, previous, and future customers we meet!

Why our Vision?

The lower and middle-class is eroding! The pawn business has not evolved since inception. Families are experiencing the cost of living increase every year. Rent, car payments, mortgages, food, gas, milk, – they all seem to be increasing in price. The only items that seem to have gone down in price are technology items. However, when one thinks about it, increased technology may actually increase the cost of living because it creates a more productive process, thus eliminating the need for human labor. Pawning is thought of in a negative manner, but when used wisely, it can provide a cash flow boost to families and individuals who need the extra cash. I like to compare pawning to Uber, in the sense of disruption that both businesses had; Uber changed the taxi business, and we believe our method of pawning will change the way the pawn industry is viewed. Pawning with the use of technology and innovation is our vision for the future of the industry of what we call “micro collateral lending.” Large banks typically want nothing to do with pawning because the fractional reserve system is not scalable in the pawn industry. It is, however, with the structure that we have come up with for the pawn industry through artificial intelligence, machine learning, partnering with local jewelers, pawnbrokers, banks, and maybe even large jewelers such as Signet, who would provide value to their customers through an additional revenue source. With the GoldPawnerShip app, you have your license and passport information stored on your account. You simply request a pawn or sell through the app at the closest Gold PawnerShip location anywhere in the United States. The local jeweler, pawnbroker, or bank has your information and they will evaluate your items in person and give you the funds you need on the spot. All in a seamless, fast, digital way. The jeweler, pawnbroker, or bank will send you a digital copy of the receipt and picture of your items directly to you. All in the palm of your hand. No more dealing with old miserable traditional pawn shops that are stuck in the 1920s with misplaced paper receipts, receipt fees, and storage fees.

If you think about the value and the propensity to spend that comes from a pawn transaction, its effects on the real economy can be far-reaching. A pawn transaction can be powerful in the sense that the pledgor is bringing in his/her gold to borrow against, and the jeweler, pawnbroker, and the bank will receive interest payments from the pledgor. The pledgor then uses the money to buy services or items and hence creates a velocity of money around the one simple transaction. By structuring the pawn business like this, it eliminates the cost of building out brick and mortar stores. Pawning is inherently a local business, where face to face interactions matter. We believe pawning will ultimately lower the cost of borrowing money for customers around the United States and beyond.

Please Fill Out the Form for an Immediate Response!

"*" indicates required fields